The GEPF is aware of an interview held with Mr. Zirk Gous, Spokesperson of AMAGP that

has been published on the YouTube channel, Biznews TV under the headline, “R33-billion in

pension funds squandered on high-risk, politically-driven investments” that is being

shared on social media. A summary of the interview has also been published as an article on

the business website, BusinessTech under the headline, “R33 billion in pension savings

down the drain”. In the interview, Mr. Gous makes a number of inaccurate statements about

the GEPF, its investment policy and investments. This statement is intended to provide clarity

on some of the matters mentioned incorrectly about the GEPF.

The statement that that the GEPF has squandered R33 billion is not accurate. The GEPF has

grown from a R127 billion fund at its formation in 1996 to a value of R2.38 trillion worth of

assets under management (AUM) as at 31 March 2024, the highest in its history. The Fund

recorded growth of 2.6%, which represents a growth of R61 billion and an annual return on

investment of 4.9% in FY2023/24. The GEPF’s 10-year annualised return was 7.2% for the

period 2015-2024, demonstrating financial stability with a funding level of 110.1%. Despite the

volatile economic environment, the GEPF remains financially strong and resilient.

On the matter of Daybreak Farms, it is important to clarify that the GEPF is not the sole owner

of the entity. The GEPF holds a 33.33% share of the company with the Compensation Fund

(CF) and Unemployment Insurance Fund (UIF) holding proportional shares of 33.33% each.

This implies that any investment outlays into the entity or financial losses would be determined

according to the shareholding structure of the company. The GEPF like members and

pensioners is justifiably concerned about recent developments at Daybreak Farms. However,

the business rescue process is welcomed under the circumstances and the GEPF will

continue to watch the process closely as it unfolds to ensure that the Fund’s value and

members’ interests are protected.

It is inaccurate that the Minister of Finance approves the investments made by the GEPF. The

responsibility rests with the GEPF Board of Trustees as directed by the GEP Law, Investment

Policies and through the Investment Mandate that guides the Public Investment Corporation

on how to invest. The GEPF Board’s primary concern is that activities are in the best financial

interests of the Fund and its beneficiaries, while promoting socio-economic transformation.

The GEPF Developmental Investment Policy guides the GEPF in investing to promote socioeconomic transformation objectives. These are return-seeking, sound investments that

support and advance the transformation of the financial services sector and encourage the

development of black-owned asset managers, including public/listed market fund managers,

private market managers, stockbrokers, audit firms, actuarial service providers and emerging

financial service providers.

Regarding impairments, it should be noted that an impairment is the incurred expected loss

on an asset given the current available information. These expected losses are updated

independently on an annual basis, and this is verified by the GEPF’s external auditors. An

impairment is raised when the following is deemed to have occurred in an investment:

- Uncertainties on the going concern on audited financial statements of its investees

- Actual breaches of any original funding agreements that resulted in renegotiation of

those agreements - Where cash flow projections have been revised downwards, it resulted in a decrease

in enterprise values of investees - Anticipated pressure on investees in servicing their debt obligations.

The above conditions are affected by macro-economic variables and positive developments

result in a reduction of the impairment value, shown as a reversal (as shown in page 151 of

the 2023/24 annual report which can be found on the GEPF website, https://gepf.co.za/annualreports/). Furthermore, the GEPF acknowledges the findings from the Mpati Commission of

enquiry and has implemented recommendations relevant to it, including the enhancement of

oversight and monitoring over its investments in a revised investment management agreement with the PIC.

We welcome Mr. Gous’ accurate statement that the GEPF is neither under any financial threat

nor are pensioners at risk of not receiving their monthly pensions. The GEPF is financially

healthy and is fully funded. This means the Fund has enough money to pay all pensions now

and well into the future. The last full actuarial valuation, which looked at the financial position

of the Fund as at 31 March 2024, showed that the GEPF had over 119% of the money it

needed to meet all its obligations – including a buffer for unexpected events. This is an

improvement from the previous valuation, performed as at 31 March 2021, which reflected a

funding level of 110.1%. The Fund continues to pay all pensions and other benefits in full.

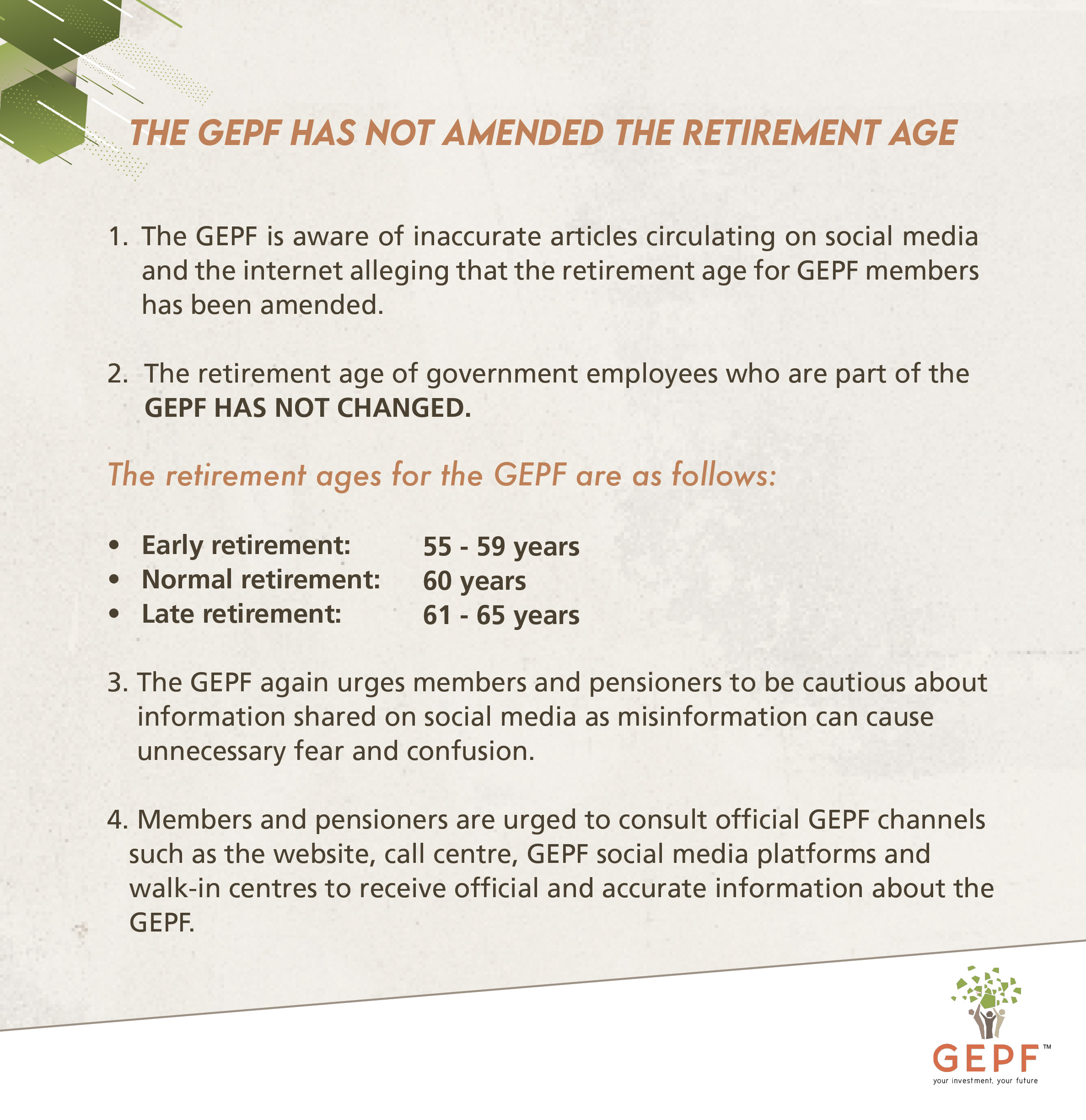

In closing, we urge members and pensioners to be cautious about information shared on social

media. While it is important to raise concerns and ask questions, it is equally important to

check the facts. The GEPF remains committed to transparent and responsible management

of the Fund. Our priority is, and has always been, to protect the interests of our members and

pensioners.

Issued by the Government Employees Pension Fund